In a plot twist nobody saw coming, U.K. inflation took a dive to 7.9% in June, a pleasant surprise for many. This unexpected drop comes after a relentless climb in prices that had been putting the squeeze on both households and businesses alike.

New data from the Office for National Statistics (ONS) reveals that inflation rates have hit their lowest mark in 15 months, offering a glimmer of hope to those feeling the pinch and suggesting a potential change in the economic winds. The drop surpassed expectations, sliding down from 8.7% in May to an estimated 8.2% in June, according to forecasts.

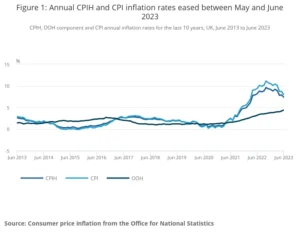

U.K. inflation. Source: Office for National Statistics (ONS)

The U.K.’s inflation rollercoaster had been on an upward spree, hitting a jaw-dropping peak of 11.1% back in October 2022.

Experts attribute this surprising decline to several factors, notably the slowdown in global commodity prices, which has taken some weight off the U.K.’s import bill. Businesses have also stepped up efforts to cushion the blow of rising costs, offering a bit of respite to consumers.

The drop in inflation could have a significant ripple effect across the U.K.’s economic landscape. For everyday folks, it might mean a bit of relief from the relentless climb in prices for essentials like groceries, fuel, and housing. While it won’t necessarily mean prices will drop across the board, it could take some pressure off strained household budgets.

Businesses, too, have been grappling with hefty production costs, which have translated into higher prices for goods and services. A reduction in inflation could help ease some of these burdens, potentially leading to more stable prices in the marketplace.

For those with mortgages, the drop in inflation could spell some welcome relief. After a tough period of soaring payments due to interest rate hikes, lower inflation might ease the pressure on homeowners struggling to keep up with repayments.

But what about the Bank of England (BoE)? Economists remain divided on whether the drop in inflation will sway the BoE’s decision-making come August. While some believe it might lead to a more cautious approach, others aren’t convinced it’ll be enough to deter further interest rate hikes.

Meanwhile, across the pond, the U.S. is facing its own battle with inflation. Though the numbers have improved slightly, there’s still debate over whether further rate increases are necessary to keep inflation in check.

While the recent drop in inflation is promising, getting back to more stable levels will likely take time. As policymakers on both sides of the Atlantic weigh their options, the road ahead remains uncertain.

The sudden drop in U.K. inflation offers a ray of hope in an otherwise uncertain economic landscape. While it’s too early to declare victory, it’s a step in the right direction—one that could bring relief to households and businesses alike. As the world watches and waits, the next moves from central banks will undoubtedly shape the path forward.